IHS iSuppli announced that, according to its research, large-sized (10-55″) LCD panel prices continued to decline in February 2011.

IHS iSuppli announced that, according to its research, large-sized (10-55″) LCD panel prices continued to decline in February 2011.

For more information visit: www.isuppli.com

Unedited press release follows:

Large-Sized LCD Panel Prices Decline in February

El Segundo, Calif., February 28, 2011—Pricing for large-sized liquid-crystal display (LCD) panels are continuing to decline in February in light of soft demand and rising inventories, but the situation could improve by April when brands increase their TV panel purchasing, according to IHS iSuppli research.

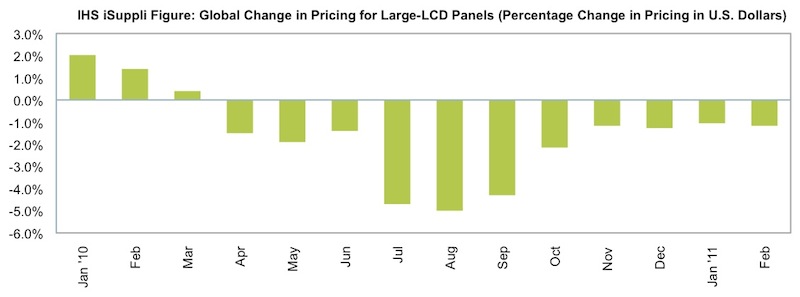

Prices of large-sized LCD panels, defined as those ranging from 10 inches to 55 inches in the diagonal dimension, are projected to fall 1.2 percent on average across the product’s three main applications of televisions, monitors and notebooks. Price declines in the 1 percent range have been the norm in the last four months, and panel prices as a whole have not risen since March 2010, as shown in the attached figure. In particular, pricing for TV panels fell throughout the period, while that of monitor and notebook panels rose slightly in October and November.

“The current price retreat can be traced to escalating inventory for both suppliers and buyers,” said Sweta Dash, senior director for liquid-crystal displays at IHS. “While average inventory among panel suppliers stands at a normal 29 days, some suppliers are seeing a decrease while others are witnessing a surge, so the situation in general is more ambiguous than what inventory levels suggest.”

Among branded vendors, Dash said panel inventory is at three to six weeks, considered normal to slightly high. Both sides, however, expect inventory to rise further this month because there are fewer days in February, translating into a shorter working period in which inventory can be used.

How pricing will fare during the next few months depends on two critical factors—final sales figures from the just-ended Chinese New Year holiday, as well as upcoming television launches in the United States and Europe. If sales on both fronts prove strong, panel inventory will return to healthy levels in April, helping overall panel prices to stabilize and perhaps stem the ongoing slide, IHS believes.

The February price decline contrasts markedly with conditions a year ago when panel prices were rising. Also this time last year, the large-LCD market faced glass and component shortages as well as labor issues that kept production levels down. Brands boasted low inventory levels then, and demand overall was strong.

Pricing to drop across the board

Among large-sized LCD TV panels, prices in February are expected to tumble 1.2 percent. Nonetheless, the decline in prices has been slowing since October, and the February contraction is the smallest since June 2010.

Panel pricing could even out in the next two months, in time for the April launch of new TV models and for China’s Labor Day holiday in May.

The smallest change will be in the notebook segment, with pricing of large-sized LCD panels for these PCs projected to dip just 0.9 percent. However, the notebook panel outlook is seriously hampered by weak consumer demand for the product, along with a harder-to-dispose notebook inventory that still features old microprocessors.

As a result, both channel and branded vendors remain extremely cautious in acquiring additional panels specifically targeted for notebooks.

In the coming months, the notebook segment will be impacted further, as media tablets like Apple Inc.’s iPad gain more prominence in the consumer markets. Already, manufacturing capacity is shifting to the production of touch-sensor panels, and suppliers are cutting media tablet panels ranging from 7 inches to 11inc hes at the expense of notebook panels, IHS iSuppli research indicates.

A price drop in the range of 1.2 percent also will apply to monitor panels this month. A rise in panel inventories among brands, combined with an increase in panel supply due to advance preparations for February, triggered softness in pricing.

Learn more about what’s happening in the LCD market with Dash’s latest report, entitled: Large-LCD Prices Feel the Pressure of High Inventories.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.